Weekly Market Update

What is the state of the markets

almost a month after the conflict?

CIO Views – Bottoming process 1/2

US, making fun of good old Europe. As net exporter of oil they can easily suggest to cut off Russia.

- Remember the US Market reversal on 24th Feb

- Currently we track approx +8.5% since

- We crossed 50d MA and are touching 150d, short term exhausted

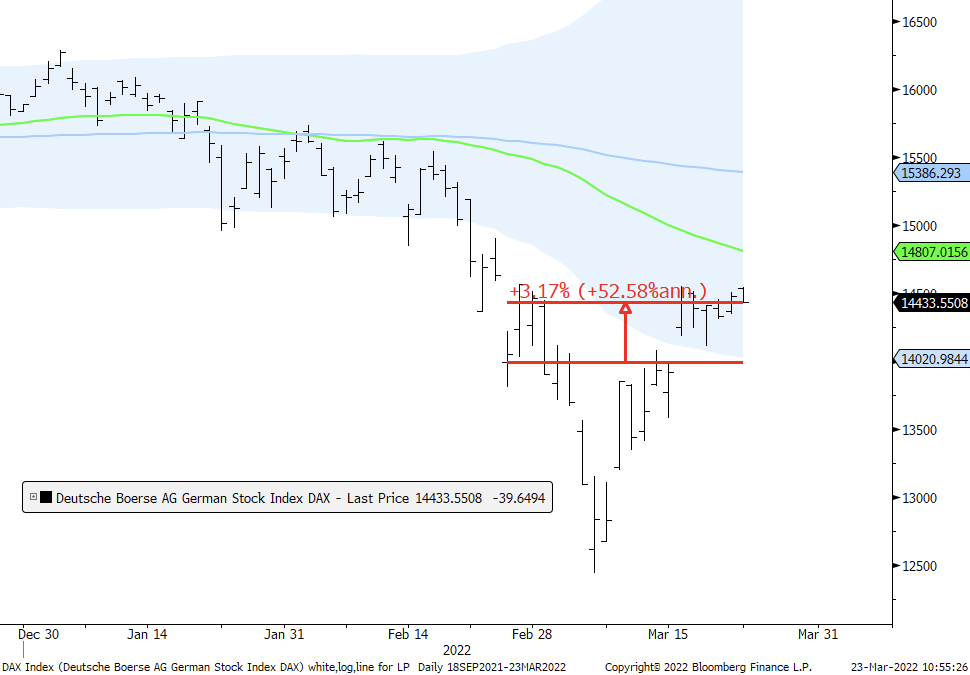

CIO Views – Bottoming process 2/2

Even the DAX back in green, approx +3.2% since 24/2

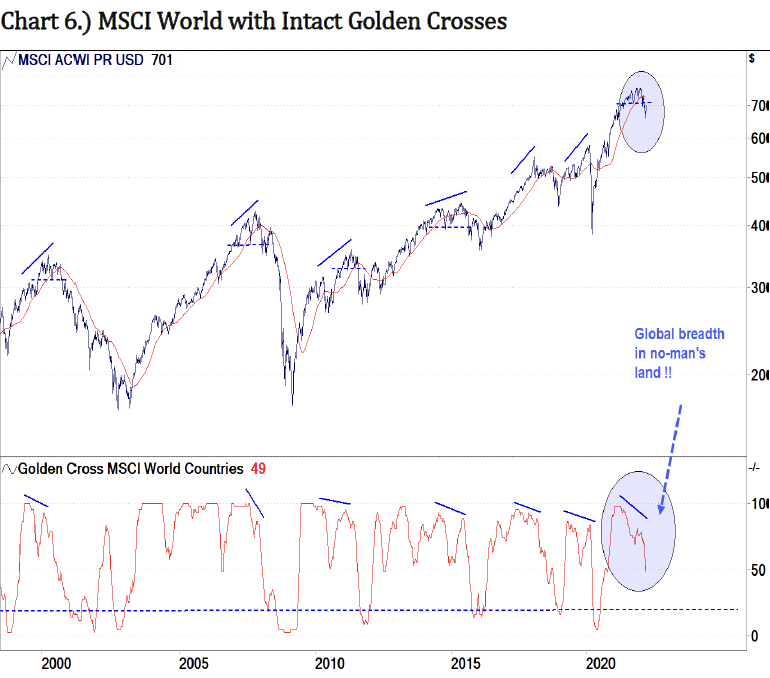

CIO Views – Equity market technicals in no-man‘s land

M.Riesner:

Conclusion: The March 15th low was definitely NOT a major low in global equities. The consequence is that the current rebound will be just part of a corrective bear market rally, which can be complex and longer lasting but where at the end of the day the real breakdown in the US still ahead of us. Translated this means, that Q1 was/is the time window where the markets are digesting and pricing the geopolitical crisis and fallout around the Russian/UA war. However, the real threat is still ahead of us, which was and remains the core scenario of our 2022/2024 bear market call. With the central banking cycle having peaked and the Fed commitment to bring inflation back under control, global markets are moving into tighter financial condition, and this has just started impacting markets via higher TED spreads and OIS spreads. The next breakdown attempt in global equities we will see at the latest in H2, which pattern wise can be a wave C but where also a wave 3 breakdown we cannot rule out as over owned mega cap technology has yet not really started with its bear market.

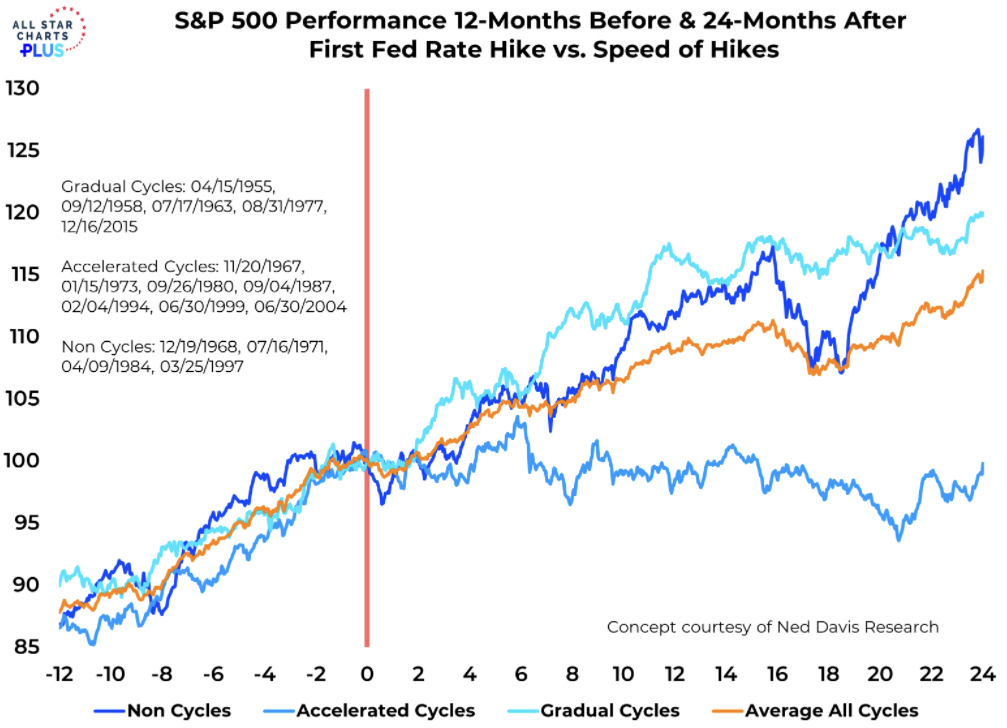

CIO Views – Historical data suggests flat equity markets for longer

Observation:

- Higher rates reflect a strong economy

- Reflation means higher equity markets in the shorter term

- Accelerated cycles ressemble current expectations, suggesting flat equity markets

- Historical real competition from bonds is still elevated, possibly around 4-5%

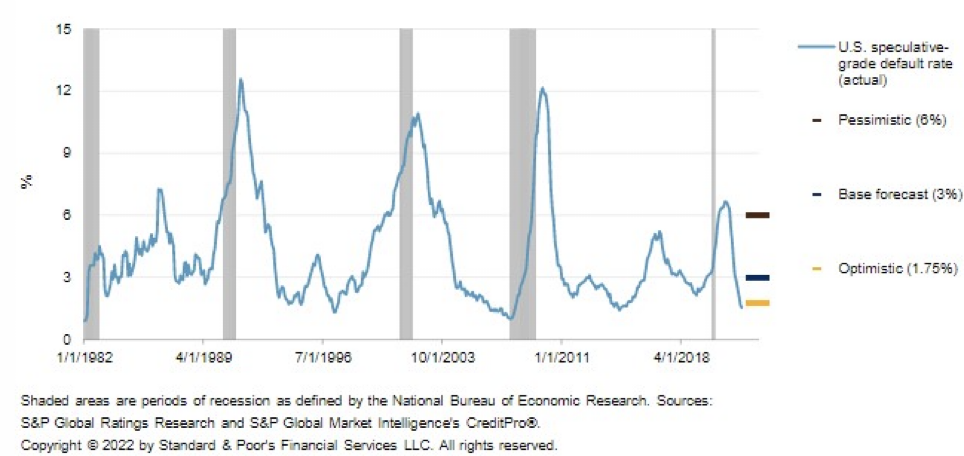

CIO Views – Blow off top in in yields

The action:

- Geopolitics driven inflation spikes are pushing higher

- Central banks wording is harsh

- Markets are looking through, impressive

- Waste and large underweight in bonds is helping multi-asset managers

What to expect:

- US YoY inflation prints could go double digit (!)

- Short term noise, „interest rates are killing stocks“

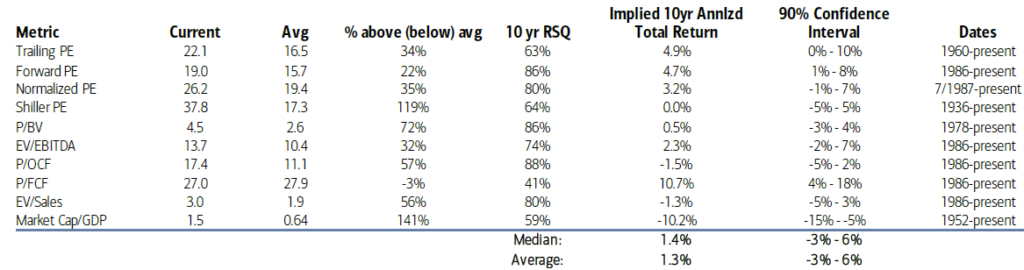

CIO Views – Empirical sad truth

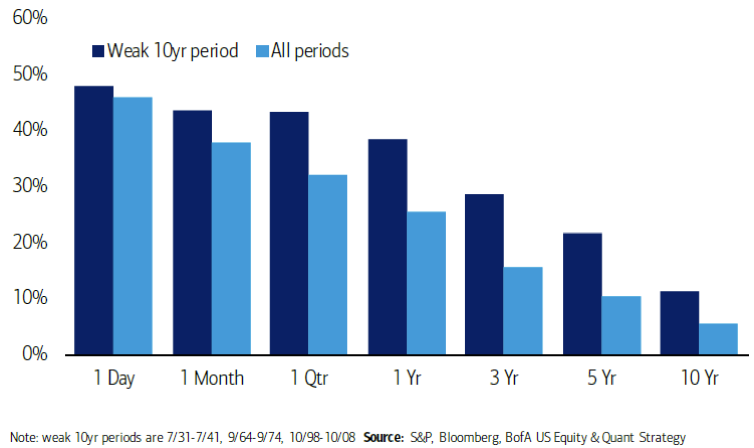

Findings:

- The valuation Range is suggesting 1.3% gross p.a. returns ahead

- In weak decades you have a high 40% probability to be negative after one year

Conclusion:

- Stay course, respect your strategy

- Rethink the allocation on a sugar high

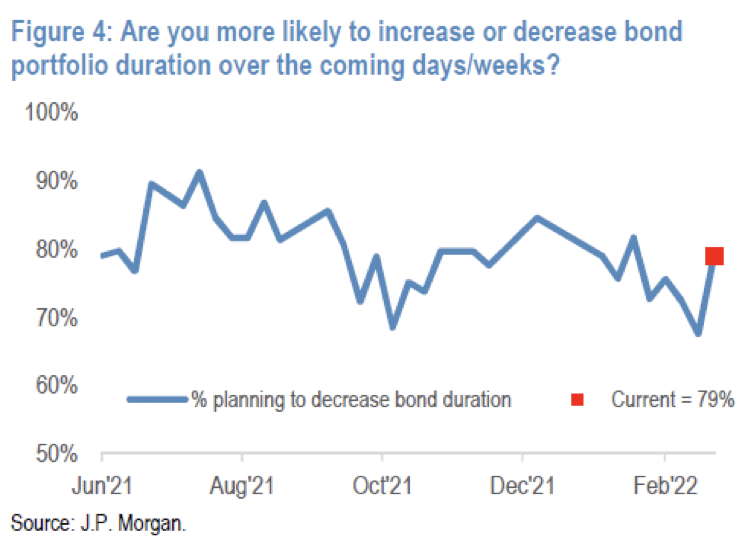

CIO Views – Nobody likes bonds, for a reason

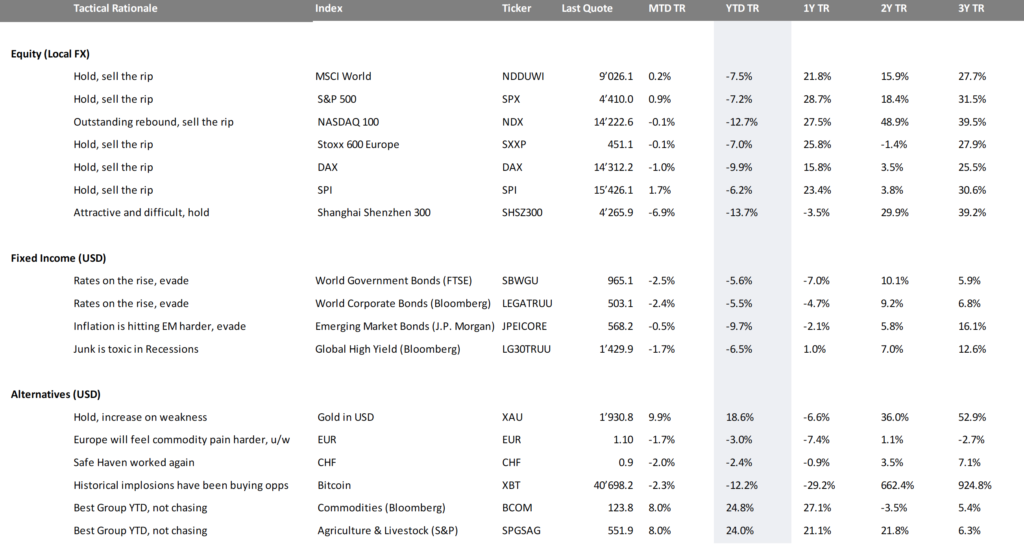

CIO View – Asset class overview & tactical rationale

What is the trend in the commodities market?

Oil shortages will stay for longer, no normalization in sight. However, suggesting a super cycle is wishful thinking. This is not a supply shock. LME works disorderly on top, base metals remain in bull mode. I am not chasing the complex no more, only adding downstream as driving season will remain strong (holiday booking are impressive). Talking crack spread.

China’s situation:

it is charging the various states in yuan, a change from the previous period. This has led to an increase in the value of the yuan and to a process of “de-dollarisation” aimed at affecting the USA. Correct, China will secure easy access to various precious ingredients and foster the superpower position. On top of that China can behave as the only grown up in the room, ending the pressure on financial markets regulation and enlarging QE (when ROW is going into QT). Keep in mind, the West will now deeply distrust the Chinese. Capital flows pushing their currency higher are not a good likelihood.